Functional obsolescence took center stage in a recent property tax appeal situation. In particular, we analyzed how the development of new technology influences the value of older, less advanced equipment–in this case, glass coating machines–and how the resulting loss of value due to functional obsolescence is calculated according to best practices, or valuation standard of care.

Functional obsolescence took center stage in a recent property tax appeal situation. In particular, we analyzed how the development of new technology influences the value of older, less advanced equipment–in this case, glass coating machines–and how the resulting loss of value due to functional obsolescence is calculated according to best practices, or valuation standard of care.

What is Functional Obsolescence?

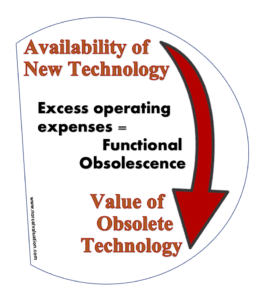

Functional obsolescence is the loss in value or usefulness of a property caused by inefficiencies or inadequacies of the property itself, when compared to a more efficient or less costly replacement property that new technology has developed. Symptoms of the presence of functional obsolescence are excess operating cost, excess construction (excess capital cost), over-capacity, inadequacy, lack of utility, or similar conditions.

Valuing Machinery & Equipment, the ASA’s reference manual, in discussing functional obsolescence, explains that

A second type of functional obsolescence is that caused by excess operating expenses. As a result of new technology, in many cases not only is it cheaper to acquire a modern replacement asset (capital costs), but it is also cheaper or more efficient to operate the new asset (operating expense). Calculating operating obsolescence involves a comparison of the operating characteristics of the subject property to its modern equivalent, the property with which the subject would (hypothetically) be replaced.

In this particular case, new more efficient glass coaters had been developed, are readily available on the market and fully operational in similar facilities, including other facilities owned by the same glass manufacturer who owned the less-advanced coaters being appraised.

This more efficient glass coating zone / chamber technology is not only less expensive to purchase than the older technology but also greatly reduces both service costs and down time while increasing production. Clearly, this is an advancement that translates into a measurable effect for the value of the old coaters. The critical step is calculating the cost of that functional obsolescence. Note that the functional obsolescence discount is always less than the total cash savings related to the new coater technology.

Present Value Calculation

The standard of care for calculating functional obsolescence is to apply a present value calculation based upon the cost savings of the new coater technology compared to the existing coaters in the Subject Assets.

All present valuation calculations are based upon the concept of the time value of money where a dollar now is worth more than a dollar in the future. In equipment appraisal practice, these calculations are based on the relevant inputs of discount rate, term, payment amount and number of payments. This calculation is commonly referred to as a Discounted Cash Flow (DCF) calculation. The key components of a DFC calculation are the discount rate (R), the term (T) and the payment (P). Each input must be carefully determined in the context of the appraisal assignment.

Let’s walk through the process of logic and research that provided the specific inputs for calculating an appropriate reduction in value of the affected assets that could be attributed to Functional Obsolescence in this particular appraisal situation. Please note that this post focuses on the process of determining appropriate input factors rather than providing actual numbers. The numbers used in the DCF would vary depending upon the equipment being valued. The process for determining those numbers, however, would remain relatively constant.

Discount Rate

The typical annual return on investment in the glass industry, per industry sources, provides the discount rate applied.

Term

A calculated Remaining Useful Life (RUL) of the affected equipment provides the applicable term (T) input.

Payment Amount

Annual savings from the use of new technology provides the payment (P) input. In this case, (P) is adjusted so that the input reflects the after-tax benefit of the annual saving of the new coater technology, compared to the costs for the affected assets.

Calculation

These researched and calculated inputs result in a significant and defensible 30% Functional Obsolescence discount for the affected assets, the coaters currently in use. This discount applies only to the equipment itself. The related power supply would be reused for the new technology and therefore is not affected by this Functional Obsolescence discount.

The Case for Functional Obsolescence

In any case wherein new technology provides the opportunity to acquire a modern replacement asset that is less expensive than the current asset (capital costs) that is also cheaper or more efficient to operate than the current asset (operating expense), a reduction in value of the current asset must be taken into account.

This reduction in value due to functional obsolescence is best calculated, according to Valuing Machinery & Equipment, by comparing “the operating characteristics of the subject property to its modern equivalent, the property with which the subject would (hypothetically) be replaced.”

Functional obsolescence must be considered in any machinery and equipment appraisal regardless if it’s for a property tax appeal, litigation, family law, insurance loss claim or any other intended use.

Other Considerations in Calculating Value

What we haven’t addressed is the effect on the value of the lower cost of the new machines compared to the old machines. We’ll discuss this in another blog:“Reconciling Reproduction Cost New to Replacement Cost New.”

Jack Young, ASA, CPA

NorCal Valuation Inc.