Installation costs are one of the variables in equipment appraisal so let’s look at two valid reasons an equipment appraisal might not include installation values.

Installation costs are one of the variables in equipment appraisal so let’s look at two valid reasons an equipment appraisal might not include installation values.

The most obvious reason an equipment appraisal might not address installation costs is that a great variety of equipment doesn’t have any associated installation costs. Installation costs include freight, delivery, engineering, foundations, wiring and exhaust systems, along with all other costs necessary to make equipment fully functional in place such as calibration. One obvious example of equipment with no installation costs is rolling stock — this category includes not only transportation units like trucks and commercial trailers, but also most agricultural and construction equipment, as well as landscaping equipment like edgers, mowers, shredders and blowers. That’s a pretty straightforward reason not to include installation costs in an equipment appraisal. Note also that some insurance policies do not include coverage for installation costs. An equipment appraiser should review each insurance policy to determine coverage for each case.

Another valid reason an equipment appraisal might not address installation costs directly is when equipment does have installation costs (a manufacturing line or food processing facility, for instance) the appraisal value itself can preclude including that value because of a presumption that the equipment would be relocated. Many commonly used equipment appraisal values presume relocation of the equipment and machinery being valued: Fair Market Value, Forced Liquidation Value, Orderly Liquidation Value, Salvage Value, and Scrap Value. No equipment appraisal based on any of these particular value definitions would include installation values – there is no installation value once the equipment has been removed.

This brings us to value definitions that include installation values as a consideration: Fair Market Value Installed, Fair Market Value in Continued Use, Replacement Cost New, Reproduction Cost New, and Liquidation Value in Place. Equipment appraisal reports based on these value definitions always incorporate the values associated with equipment installation in the conclusion of value. Such appraisal situations might include family law, estate planning, buy/sell, and eminent domain.

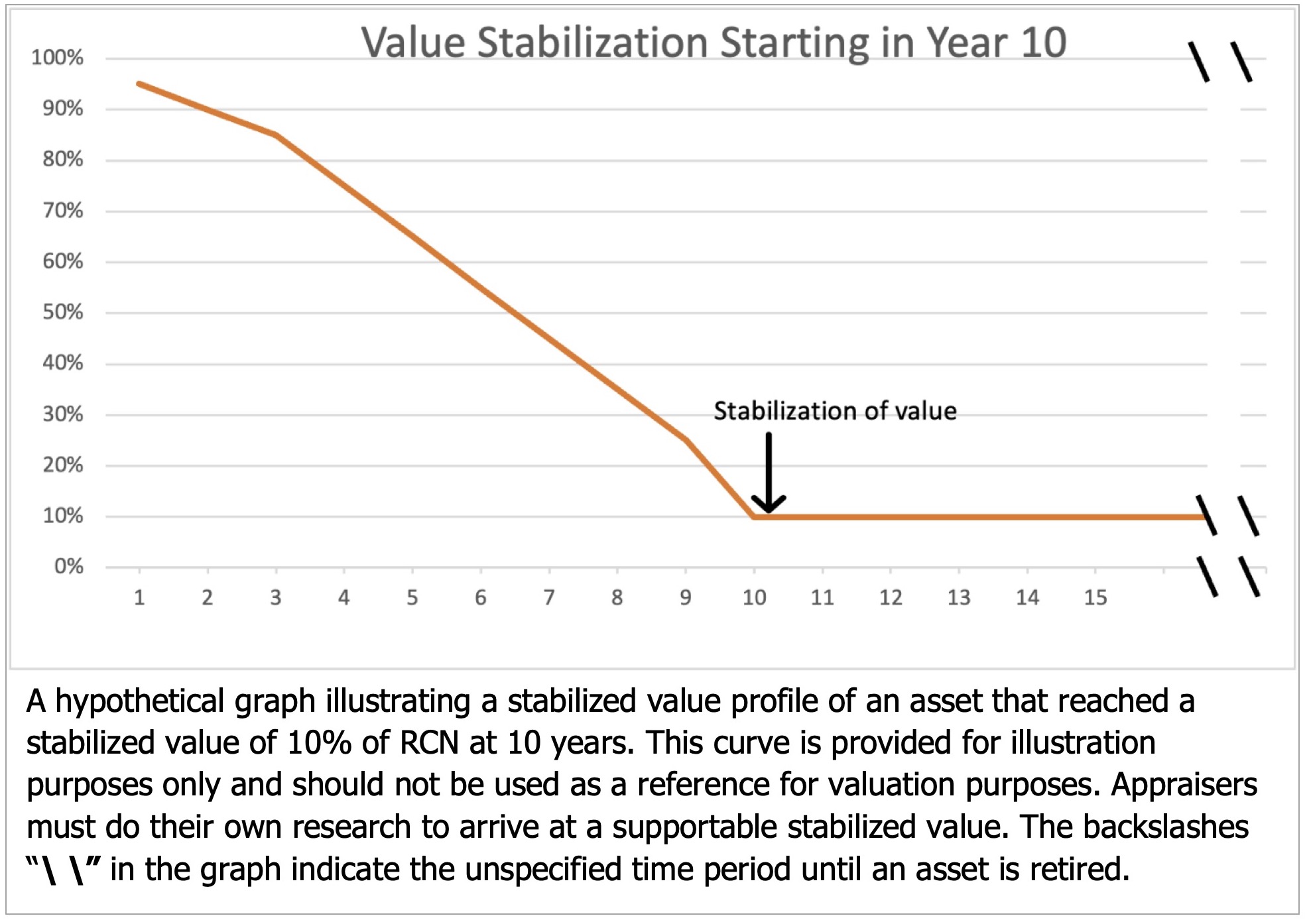

When installation values are included in an equipment appraisal, they are generally calculated using the cost approach to value, taking into consideration any depreciation as appropriate. For instance, assuming similar machines, both with a 20-year normal useful life and normal operating wear and tear, the value associated with installation for a 5-year-old machine would be greater than the value associated with installation on a 20-year-old machine. Why? Because an installation that can be used for 15 years is worth more than one that can only be used for 5 years. And neither of course, would have the installation value of a brand new machine, as in the value associated with Replacement Cost New or Reproduction Cost New.

Determining when and how to include installation costs in an equipment appraisal is one of the appraisal issues that is most appropriately determined by the type of equipment or machinery being valued and the intended use of the appraisal.

Jack Young, ASA, CPA

NorCal Valuation Inc.